A mortgage is a loan that you take out which is secured against a property that enables you to purchase your home.

The mortgage lender has the option of taking possession of the property and selling it if the mortgage repayments aren't made, to try and recoup any losses it has suffered.

The lender will charge you interest in return for lending you the money. Therefore over the term of the mortgage, you will need to pay the lender interest and repay the amount you originally borrowed fully before the mortgage ends.

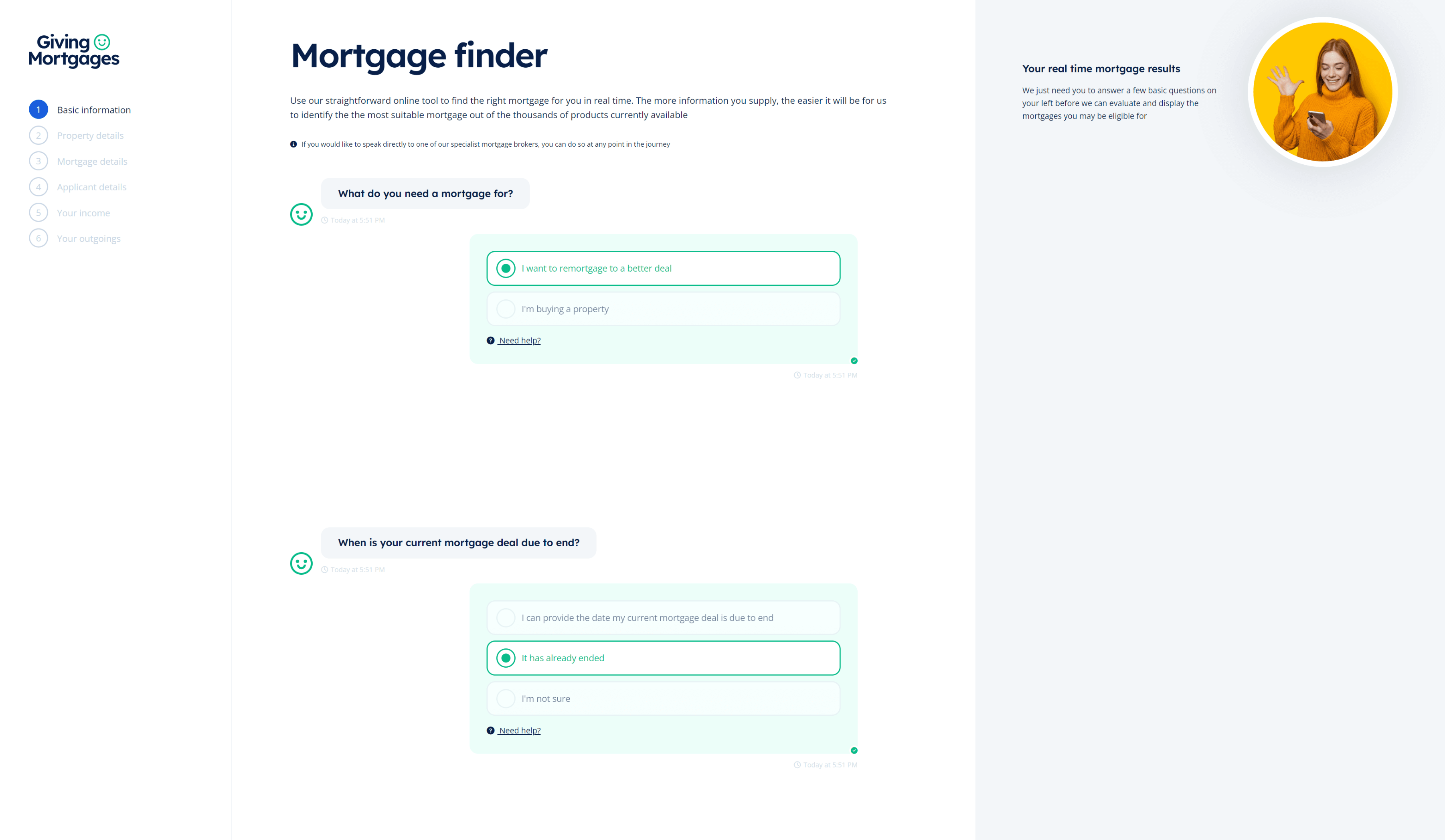

One of the most difficult aspects of organising a mortgage is sorting through the hundreds of mortgage deals currently available. Different mortgage schemes will cater for different needs. To establish what is suitable for you, it is important to take into account your current circumstances as well as your priorities and long-term plans. We recommend speaking to a mortgage adviser as soon as possible as they will be able to guide you.

Every lender will be different in their approach to what you can borrow and unfortunately there is no set calculation. The actual amount you're eligible to borrow will be determined by the cost of the property you wish to purchase, the size of the deposit you have, and your income and affordability (taking into account your monthly financial commitments and any future commitments) We will match you with a broker who will assess your circumstances and advise how much you will be able to borrow

No, Giving Mortgages collect your information and match you with an adviser who will find the best mortgage to suit you

Credit problems do not necessarily prevent you from getting a mortgage. If you have credit problems we will refer you to a broker who specialises in this area.

No, our service is free. However, some brokers may charge a fee for arranging a mortgage.